Across the US, major cities are facing the need to make unprecedented investments in upgrading urban stormwater systems to meet state and federal mandates to comply with total maximum daily loads (TMDLs) and reduce the incidence of combined sewer overflows (CSOs). Washington, DC, for example, is spending $2.2 billion on a CSO abatement program involving a system of 12.8 miles of deep tunnels to reduce overflows by 96%. As cities, already facing budget shortfalls, contemplate funding these upgrades, public works officials are increasingly looking for new ways to leverage private investment through incentives and crediting programs. Although stormwater credit programs have been around for two decades, in Philadelphia, PA, the city’s Water Department (PWD) is exploring a new stormwater incentive system that is testing the opportunities and limits of incentive-based approaches to stormwater compliance.

Philadelphia’s new parcel-based billing and stormwater crediting program, which went into effect last July, provides a potentially potent new set of incentives for property owners to invest in clean water technologies that treat and infiltrate stormwater. By all accounts, the program is the first in the nation to offer a credit—essentially a stormwater charge discount—large enough to create a potential lever for large-scale private investment. How the system plays out in Philadelphia may be a bellwether for determining what role private incentive programs will play in helping the nation’s other major cities pay for stormwater system upgrades.

For businesses like Newman and Company, a northeast Philadelphia paper recycler, understanding the new billing and crediting system and its costs and benefits is an evolving process. Newman and Company is one of Philadelphia’s industrial success stories—a family-owned paper recycling business along the northeast Philadelphia riverfront that has been able to adapt to changing times and remain viable in the wake of globalization. For Newman and Company, staying economically relevant is not easy in an industry that’s seen production shift to emerging markets overseas, particularly in the midst of a recession. So when Mike Ferman, Newman and Company’s vice president of operations, received word that his stormwater bill was going to increase by $10,800 per month ($129,600 per year) over next four years, he was understandably concerned about the financial implications for his business.

Like many non-residential property owners across the city, Ferman learned in 2009 that in an effort to more equitably allocate the true cost of stormwater management (the change is revenue-neutral to PWD), PWD would be restructuring its billing system from a meter-based system, in which the stormwater charge was determined on the basis of potable water usage, to a parcel-based fee, which bases the stormwater charge on the amount of impervious area and the gross size of the property. For many property owners, the difference would be small, but for sprawling industrial sites like Newman and Company’s, the result of the billing switch means substantial increases in annual stormwater charges.

The billing program has its roots in the 1980s, when owners of high-rise buildings within the city complained that they overpaid for stormwater management due to their high water use, while property owners without a meter, such as parking garages, paid nothing. As GIS technology advanced and allowed the city to develop detailed impervious cover mapping of its more than 80,000 non-residential properties, the city moved forward with the billing switch. The move parallels trends seen throughout the US. In fact, according to a recent nationwide survey of public stormwater utilities, more than 80% of those surveyed bill for stormwater using a similar approach.

As Ferman heard more about PWD’s new policies, he uncovered a second aspect of the program that piqued his interest. Even though Newman and Company’s stormwater bill would be increasing, the new system provided a way out. According to the new regulations, PWD would credit customers that elected to “manage” the first inch of runoff from impervious surfaces using an approved credit practice, such as a green roof, bioretention system, or constructed wetland. So, despite the short-term hike, the crediting system provided the means to virtually eliminate the stormwater bill altogether. The financial question was simple: How much would it cost to generate credit compared with the financial savings afforded by the credit?

Philadelphia’s stormwater credit program has property owners across the city asking and answering similar questions. Seemingly overnight, the credit program has created a cottage industry involving the design and construction of “green” practices that will earn property owners stormwater credits. Engineers eager to make a quick buck on the program are touting design services and offering free consultations, while customers are left to weigh a host of factors in deciding whether to engage in the market or simply pay their bill.

In many ways, the decision faced by Philadelphia water customers—whether to retrofit stormwater systems to earn stormwater credit or continue to pay their bill—is not unlike decisions faced by homeowners for decades: install storm windows around the house or upgrade to a more energy-efficient refrigerator in exchange for a lower electric bill and a clean conscience, or continue to pay higher electric bills—in other words, an upfront capital investment in exchange for long-term savings and the warm fuzzies associated with helping the environment. But for most customers, the warm fuzzies aren’t enough, and the financial details are what determine the willingness to invest. The key questions become “How much is the initial investment?” and “How long will it take to make my money back?”

As regulatory agencies increasingly look to market-based incentives, rather than outright regulation, as a more politically viable and less costly means to bring about the sweeping private sector changes needed to meet environmental mandates, and as environmental impacts are increasingly monetized, property owners may face an increasing array of similar choices. Whether it’s the decision to convert to LED lighting, install solar panels, or retrofit stormwater systems, regulators are increasingly putting the choice in the hands of the consumer and letting consumer choice and market forces drive environmental improvements.

And, as revenues continue to dwindle amidst the current financial crisis and agencies look to cut overall costs by leveraging private investment, incentive programs may gain steam. Within PWD, staff are hoping for, but not counting on, the development of stormwater credit markets as a means to lessen the sting of its mounting financial obligations, which stem from federal mandates to clean up polluted water ways. Under a long-standing consent order from EPA, PWD recently released a plan, Green Cities, Clean Waters, that outlines an investment of $2 billion to reduce CSOs over the next 25 years. This investment comes in addition to the millions the city spends each year to reduce pollutant loadings to impaired waterways draining separate sewered areas, as required by its National Pollutant Discharge Elimination System (NPDES) permit. Among other infrastructure improvements, the central control strategy set forth in the city’s plan involves the management of impervious surfaces using green infrastructure practices, the same menu of technologies that receive credit under the city’s stormwater credit program. Under the plan, PWD will manage stormwater from a third of all impervious acres draining to combined sewers within 25 years, a total acreage of more than 6 square miles.

Even though credit generation is likely to reduce revenue in the short term, it may more than pay for itself in avoided costs. In essence, PWD is paying property owners, in the form of a bill credit, for helping to soak up the billion gallons of unmanaged runoff that lies at the heart of the city’s water-quality problems. For each acre of runoff managed privately, the city may save up to $250,000 in avoided infrastructure costs, the planning-level cost estimate associated with managing an equivalent volume of runoff in public streets cited in the Green Cities, Clean Waters plan.

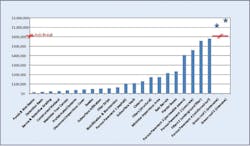

At this point, long-term program participation rates in the stormwater credit program are unclear. Still, the potential for capital avoidance is huge. For instance, the impervious area among just the 100 properties in CSO drainage sheds with the largest monthly stormwater charge increase is over 2,800 acres, or 70%, of the total 25-year management goal of 4,000 “greened” acres outlined in the Green Cities, Clean Waters plan. Looking at all properties in CSO drainage sheds, the total impervious area is staggering—some 10,600 acres, according to PWD statistics. So, even at relatively modest rates of participation, the potential for offsetting pubic investments through incentivizing privately funded retrofits is substantial. For PWD, the risk is a calculated one—that the lost revenue associated with the crediting program will be outpaced by avoided future infrastructure costs. If the risk pays off, PWD will avoid future rate hikes for its customers required to fund pubic sector retrofits.

While the idea of leveraging private investments to partially offset the costs of large public investments in environmental cleanups is an attractive one for PWD, state and federal regulators may be less comfortable with the idea of placing stormwater management in the hands of private landowners across the city. According to Joanne Dahme, PWD’s public affairs director, while regulators are generally supportive of the department’s move to green infrastructure-based solutions, both the Pennsylvania Department of Environmental Protection (PA DEP) and EPA have expressed some concern with crediting volume managed within voluntarily constructed, privately owned stormwater systems—which could be successfully built and maintained initially but may not be around for the long term—toward meeting the city’s CSO abatement targets. Unlike stormwater management features that are required for new development or redevelopment projects, stormwater retrofits are voluntary practices and landowners have no regulatory obligation to maintain the practices in perpetuity, at least in the absence of a separate legal agreement. Under the current program, landowners are required to re-register stormwater credits every four years, but could let the credits lapse.

For stormwater crediting to fulfill its potential as a viable, if not central, part of Philadelphia’s overall stormwater compliance strategies, PWD must continue to develop the program in ways that reduce perceived risk and uncertainty for regulators and customers alike. From a regulatory perspective, convincing EPA and PA DEP to credit the city for voluntary practices financed, built, and maintained by private entities toward its CSO obligations may mean requiring legal protections for privately owned and operated stormwater facilities, such as deed restrictions or easements, which may act as a disincentive to private investment. For customers, the problems, and potential solutions, are varied and complex.

Investment Barriers and Opportunities

As PWD works to reassure regulators about the viability of privately owned and maintained stormwater retrofits, it must also find ways to identify and eliminate barriers to investment for customers. Early returns suggest that while many customers are weighing their retrofit options, few have yet to pull the trigger on moving ahead with the investment. According to Erin Williams, PWD’s stormwater credit program manager, only a handful of customers have filed applications with the city to implement retrofits. While it’s hard to determine whether, how much, and how fast retrofit activity will increase, the ultimate success of the program will depend on helping customers overcome a complex set of investment barriers.

Part of the challenge may lie with Philadelphia’s vast number of small commercial properties. For small properties, annual credit savings may be in the hundreds or thousands of dollars per year, creating challenges for funding costly one-time expenses like engineering design and topographic surveying. For other customers, the risk-reward equation may be muddied by uncertainty about costs to install credit-generating practices, uncertainly about maintenance and upkeep of practices, and the perception that the credit program may either change or disappear, leaving customers holding the bill.

Another factor that may limit investment in stormwater credit practices, at least in the short term, is the lack of credit and liquidity, and generally poor appetite for investing caused by the nation’s wider economic woes. Although it’s difficult to assess this effect, some customers may be looking to wait out the current economic crisis before making any non-essential capital investments. And, since PWD’s program phases in over four-year period, customers aren’t yet feeling the full impact of the billing switch. As the economy improves and the financial rewards of crediting increase through the phase-in, rates of participation in the stormwater credit program may increase.

Other customers that are unwilling to take on the construction of credit-generating stormwater retrofit projects may look for opportunities to roll credit-generating practices into future redevelopment or expansion efforts as a strategy to reduce costs. For instance, a parking resurfacing or roof replacement project could be modified to install porous paving instead of traditional paving, or a green roof in lieu of a conventional roof. Or, credit from green stormwater practices could be used to offset the costs of landscape facelifts for the city’s many small, struggling strip malls. Customers in this category may eventually participate in the stormwater credit program, but may not be likely to do so in the short term.

Even when customers are willing to invest, incentives are not always high enough to make stormwater crediting a financially attractive option. Even in Philadelphia, where the rates of return on stormwater retrofits are higher than in many other cities with similar programs, stormwater retrofits may make financial sense only for properties that are ideally configured. For other customers, property constraints preclude easy and cheap fixes.

Under the PWD program, a range of practices including bioretention systems, green roofs, subsurface detention systems, and extended detention basins can earn stormwater credit. Although each practice earns equal credit per unit of stormwater managed, practice costs vary widely, from less than $1 per square foot of impervious area treated to $20 or $30 per square foot of impervious area treated. Generally, the least expensive way to earn credit through the program is to build a large extended detention basin that provides water-quality treatment.

For property owners lucky enough to have enough green space to build such a naturalized basin and existing piping to carry the stormwater to the facility, the credit incentives, about $4,200 per acre per year, can create a very attractive return on investment, with breakeven points occurring as little as two to four years after the initial investment.

But for other properties, the financial realities of credit generation are starker. A lack of available green space or properly configured stormwater pipes can limit retrofit options to more costly fixes, such as green roofs. Green roofs, which earn the same amount of credit per acre treated as do extended detention basins, cost approximately 100 times more to treat the same amount of impervious area. Under the program, a green roof investment, even when factoring in energy savings and an extended roof life, would take a property owner upwards of 70 years to recoup through credit savings. For many constrained properties, willingness to invest is upended by the inability to implement retrofit solutions that provide acceptable payback periods.

Finding Solutions

In Philadelphia, finding creative ways to encourage customers to participate in stormwater crediting is an ongoing focus for PWD and its partners. Of particular interest is finding so-called “early adopters,” customers who are willing to implement credit-generating practices in the early phases of the program and provide compelling success stories that demonstrate how stormwater crediting can work for private businesses. The hope is that these customers, through testimonials and word of mouth, may pave the way for more widespread participation in stormwater crediting.

Jump-Starting Investment Through Targeted Design Assistance

Since 2009, PWD has funded a program to provide free design assistance to commercial property owners looking to lower their stormwater bills through onsite management. The program is directed toward customers like Newman and Company that are facing significant increases in stormwater charges as a result of the switch from meter-based to parcel-based billing (generally increases of several thousand dollars per month). Under the program, the PWD’s design consultant, AKRF, first meets with interested customers to explain the stormwater billing and credit program and to better understand the customer’s property configuration, constraints, and existing uses. Designers then conduct a site assessment of each property, which involves locating key features such as existing storm drains and inlets and mapping drainage patterns. Using a GIS-based system, the design team develops a number of conceptual design scenarios, each consisting of various combinations of crediting practices that provide treatment for some or all of a property’s impervious surfaces. To date, the team has worked with approximately 35 property owners and has assessed and provided design recommendations for more than 1,000 acres of land.

“It’s been a great way to get property owners engaged in the process, and to provide good information so that property owners can make informed choices,” says Rodman Ritchie, technical director with AKRF and deputy project manager for the design assistance contract. Of the property owners engaged in the program, several are moving forward with design retrofits. But with 80,000 property owners in the city, the design team can meet with and directly assist only a small portion of the customers. In an effort to reach a wider segment of the customer population, PWD worked with AKRF and the Partnership for the Delaware Estuary to create a “green guide,” a publication designed to walk customers through the stormwater credit program and assist them with evaluating investment options.

Helping the “Little Guy”

To increase rates of participation for owners of smaller properties, PWD has set up a “walk-in” design assistance program, through which property owners can receive targeted design assistance from an engineering consultant. Similar to the design assistance program, the walk-in program specifically focuses on helping smaller property owners find low-cost retrofit solutions. Solutions may involve using onsite materials, equipment, or labor resources to offset the cost of a traditional construction project, or putting customers in touch with local watershed or community groups that may be able to provide low-cost materials, grant funding, or volunteer labor to reduce costs.

North American Street: Bridging the Public-Private Divide

Along North American Street, PWD staff are exploring another option that may help smaller commercial customers take advantage of stormwater crediting. More than 120 feet wide in some sections, North American Street feels more like a highway than an urban street. Traffic is sparse, and the wide swaths of pavement seem oddly out of place with the corridor’s level of activity. A relic of a more prosperous past, the street corridor was once of the city’s major thoroughfares. But today, the rail line that runs down the middle of the street now lies idle, and at first glance North American Street can feel like a main drag in an urban ghost town.

In recent years, however, the corridor has enjoyed an economic renewal of sorts, and a handful of new businesses now provide the core of an emerging, but still fragile, business district. Not far away, the new urbanism renaissance of Philadelphia’s Northern Liberties neighborhood signals the possibilities of an economic boom that businesses and property owners along North American Street hope may yet come their way. For PWD, the featureless street corridor offers a different, but related, set of possibilities. Retrofitting the street with curbside bioretention systems and tree trenches would offer the potential to effectively manage street runoff while also making the corridor more attractive to infill development.

But, unlike traditional green streets projects, the North American Street project would also set aside storage capacity to treat private runoff. Private businesses along the corridor could elect to either pay their stormwater fee or, alternatively, route their runoff into a stormwater management practice located within the public right of way. Presumably, private actors would help to cost-share the public stormwater improvements through a variety of mechanisms including a one-time payment, partial forfeiture of credit for a period of time, or by agreeing to operate and maintain one or more public practices. Working out the details of how this happens is an ongoing process, but at a minimum, the North American Street model creates an intriguing possibility of how public-private partnerships could provide more flexibility for small property owners looking to benefit from stormwater crediting.

Searching for Regional Solutions

Miles away from North American Street, in the sprawling light industrial landscape of warehouses and distribution centers, PWD and Philadelphia Industrial Development Corporation (PIDC), a nonprofit organization charged with stimulating the city’s industrial sector, are working to pilot a different regional management model that might provide alternative crediting mechanisms for some of the areas industrial landowners. The concept would involve diverting a combination of public and private runoff from a 40-acre drainage area into a regional basin located on property owned by PIDC. In exchange for building and operating the basin, PIDC would recoup a certain percentage of stormwater credits earned by customers within the contributing drainage basin, at least until the initial capital costs could be recovered. From there, customers would presumably pay a yearly fee to cover operations and maintenance costs associated with the regional facility.

One of the key advantages to regional management is the low cost of treatment associated with building stormwater treatment systems at a large scale. For new development, the economy of scale associated with large systems is often offset by high conveyance costs. But for retrofits, the conveyance systems already exist, making large-scale treatment a far more cost effective solution than distributed systems.

“Cheap, Patient Money”

To the degree that access to financing acts as a barrier to participation in the credit program, access to low-interest financing may increase rates of participation in the short term. In response to this perceived need, PIDC has partnered with PWD to set up a low-interest loan program, the Stormwater Management Incentives Program (SMIP), which is available to properties throughout the city that wish to invest in retrofit projects. The SMIP offers property owners up to $1 million in financing at an annual interest rate of 1% to fund design and construction of retrofit projects.

“We’re looking to provide cheap, patient money to customers who are looking to fund a capital investment,” says Liz Gabor, a real estate manager with PIDC. Although the program was only recently unveiled, initial indications are that customers have been slow to respond, suggesting that customers either may not be aware of the program or are electing to stay on the sidelines for other reasons. According to Gabor, however, efforts to publicize the program are just beginning. “We’ve received one application to date, and one is currently being prepared. But we haven’t really made much of an attempt to market the program just yet.”

Despite PWD’s efforts to lower uncertainty and risk, some customers have elected to fight the parcel-based billing and credit program rather than participate. Recently, a coalition of businesses, the Unified Business Owners Association of Philadelphia, led by American Box Corporation, have banded together to fight PWD’s billing increase. The coalition argues that the billing increases, which are modest for most but significant for many larger industrial properties, may force some businesses to leave the city. For these businesses, particularly those located on properties without low-cost retrofit options, the prospect of spending additional capital on a stormwater retrofit project isn’t much consolation.

But despite the criticism levied by the Unified Business Owners Association of Philadelphia and others, in citywide terms, the parcel-based billing and credit program is a double-edged economic sword. On one hand, the program increases the cost of doing business for the city’s already beleaguered industrial sector. However, the program also creates a new market for investments in private infrastructure that produce public benefit and create new jobs for engineers, contractors, and environmental professionals. And, for property owners like Newman and Company, the credit program has led to a more holistic and encompassing view of water usage that has opened the door to a range of innovations.

For instance, Ferman, aided by the PWD design assistance program, began to explore other ways, in addition to stormwater credit, in which Newman and Company could upgrade its water systems to lower costs. Since Newman purchases approximately 68 million gallons of water per year from the city to meet cooling and process needs, early design concepts quickly turned to potential for achieving stormwater credit through implementing a rainwater harvesting system that would also reduce potable water needs. Newman and Company is now proceeding with preliminary design of a rainwater harvesting system that will reduce process water consumption by 10% and save approximately $4,400 per month in avoided potable water and stormwater charges.

Therein may lay the key to the stormwater billing program. As businesses like Newman and Company begin to view water as a commodity and become more financially accountable for the impacts of their water use, they may increasingly act in ways that benefit both public waterways and their own bottom lines. In the end, this alignment of economic and environmental goals may prove to be a win-win for public and private interests alike.

Already, there is evidence that the stormwater credit program is stimulating a wave of entrepreneurial activity within the city. For instance, many civil engineering firms have begun offering stormwater credit consultation and design services to their customers, helping to educate customers about the program and to work with customers to identify and evaluate retrofit projects. Competition among engineers, contractors, and other professionals for stormwater crediting contracts may help to reduce design and implementation costs, helping to further stimulate participation in crediting.

For some professionals looking to stormwater crediting as a potentially new market, frustrations at the slow pace with which customers are embracing the credit program is the norm. “A lot of people want to talk about it. But their first reaction is to fight it. To them, writing a check is like admitting defeat,” says Lou Rodriquez, a former PWD employee who is now a partner in Aquaeconomics, a design-build firm specializing in offering stormwater credit consultation and design services.

For Rodriquez and other entrepreneurs looking to take advantage of the credit program, customer frustration and anger at the sometimes-steep increases in stormwater charges seems to be one of the biggest and most difficult barriers to investment. “As long as customers feel there is a chance the program could fall apart, they won’t invest [in stormwater credit-generating practices],” says Rodriquez.

Beyond Philadelphia

Many jurisdictions across the country have implemented parcel-based billing systems for stormwater, similar to the new Philadelphia billing system, but in all but a few instances, programs aren’t configured to offer a large enough financial incentive for property owners to invest in significant retrofit projects. In some jurisdictions, unit stormwater charges simply aren’t high enough to incentivize investment even if programs provided 100% credit for retrofits, which is rarely the case.

For instance, New York City Department of Environmental Protection is piloting a stormwater parcel-based charge and credit program directed toward parking lots. Under the program, parking lot owners would be charged $0.05 per square foot of impervious surface per month, less than half what Philadelphia’s non-residential customers pay, and would be offered a credit of up to 50% of the charge for implementing an approved retrofit. Given New York City’s higher design and construction costs and the fact that parking lots often preclude low-cost retrofits (e.g., large basins), the New York City program faces even greater challenges than those in Philadelphia. Credit programs in Washington, DC, and other municipalities also seem unlikely to generate the level of incentive needed to stimulate wide-scale private investing, either because of lower user fees, more modest crediting policies, or a combination of the two. To date, Philadelphia’s credit program, because of its relatively high unit stormwater charges and an aggressive crediting policy, is the lone example of a stormwater crediting program that provides real promise of leveraging significant private investment.

Like Philadelphia, Portland, OR, has a stormwater credit program, Clean River Rewards, that provides customers who provide onsite stormwater treatment with a billing credit, and it has a relatively high annual stormwater charge ($0.10 per square foot). But unlike Philadelphia’s program, Clean River Rewards, which has been in place for many years, credits only the onsite portion of stormwater charge, which accounts for 35% of the total stormwater charge.

As a result, the credit hasn’t provided enough incentive to compel private owners to invest in stormwater systems. Most of the approximately 55,000 program participants consist of property owners whose stormwater systems have been installed as part of mandatory redevelopment or new development projects, or that have disconnected downspouts through a downspout disconnection incentive program. Dan Vizzini with the Portland Environmental Services Bureau says that unlike Philadelphia, Portland is in the final phases of implementing its CSO mitigation plan and, as a result, anticipates relatively fixed infrastructure costs in the short-to-medium term. As a result, in Portland, the prospect of avoided capital costs doesn’t provide the justification for a more aggressive crediting program that might result in short-term operational deficits. “We really don’t have the level of capital investment that would allow us to recoup forfeited revenue in the form of avoided capital costs,” says Vizzini.

Looking Ahead

Improvements to Philadelphia’s stormwater credit program may continue to focus on ways to make credits more attractive and to increase rates of participation. In March, PWD began a six-month study to evaluate the current credit system and develop recommendations for improvements. Many options are on the table.

“We don’t know all the answers right now,” says Dahme.

For example, PWD may consider putting in place a credit-trading framework within which property owners could buy and sell stormwater credits on an open market. Such as system could help make crediting an option for properties that are priced out of crediting through onsite retrofits because of difficult property conditions. Property owners unable to implement retrofits on their own properties because of high construction costs could purchase credits from property owners in other locations that have more favorable property conditions and choose to over-manage stormwater on their site to generate salable credit.

Another option that may make crediting viable for more of the city’s customer base would be to allow customers to fund public stormwater projects as an alternative to funding a retrofit on their own property. Under this model, PWD would create a project registry of pre-approved, low-cost retrofit projects on the city’s public properties (e.g., schools, parks) and would implement these projects through a privately funded trust. The concept would allow private owners to earn credit either by directly mitigating their own impacts, or by offsetting their impacts through funding a public project. This model may also be a more palatable option for regulators who are looking to PWD to ensure the long-term viability of green stormwater management systems used to mitigate CSO impacts.

As Philadelphia’s credit program continues to evolve, the challenges and rewards seem clear. For PWD, if barriers to private investment can be lowered through credit policy changes and creative solutions, and if state and federal regulators eventually buy in to the notion of placing at least some of the burden of CSO compliance in hands of private actors, stormwater crediting could translate into significant long-term reductions in capital expenditures. But ultimately how successful the program becomes rests in the hands of the city’s thousands property owners, who must weight their options and decide whether to invest or simply continue paying their stormwater bills. How all of these decisions collectively play out will go a long way in determining the future of stormwater crediting in Philadelphia, and beyond.